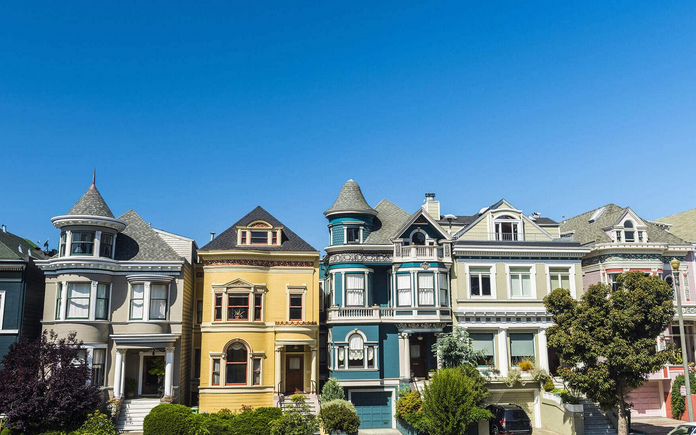

Commencing a business demands a great deal of work and plenty of capital. One of the important Real Estate san francisco challenges for most business owners is money their vision and turning it into a reality. San Francisco is a hub for startups and technician businesses, but obtaining a financial loan from classic banks can be tough. That’s why private loaning options could possibly be the most suitable option for many internet marketers in San Francisco. In the following paragraphs, we’ll check out San Francisco personal lending alternatives and how they can assist business owners in acquiring the capital they need to boost their business.

Knowing Personal Loaning Remedies

Individual loaning solutions operate differently than standard banking institutions. These are typically more versatile, less bureaucratic, and will probably look at a borrower’s personality and guarantee as an alternative to credit ratings. Private loan companies could be folks or companies that use their money to lend to individuals at the fixed interest rate or variable costs, based on the loaning terminology. One of many substantial great things about personal lending solutions is definitely the versatility they provide.

Files you need for the individual financing answer

Before you apply for the private loaning option, it’s essential to have the needed files, which include business strategy, financial assertions, a minimum amount of value, management composition, personal data, and security. The records needs may differ in line with the loaning conditions.

Discovering the right loan provider

Choosing the best loan company is essential to the prosperity of funding your startup in San Francisco. Study and community to determine which personal creditors are the most useful in shape for the business needs. Consider the market experience of the lender, their reputation, financing conditions, and rates prior to making one last selection. Take the time to look for a loan provider who understands your business vision and may give personalized funding alternatives that provide what you need.

Benefits of Exclusive Financing Remedies

Among the important great things about private lending alternatives is freedom from your common limitations enforced by traditional banks. Private loan providers offer you far more versatility for debt restructuring and modification, such as negotiated financing conditions, interest levels, and settlement agendas. Private financing options in addition provide quick access to funding, skipping the extended endorsement technique of classic banking companies.

Dangers Engaged

Just like any financial loan item, you will find hazards involved with personal creditors. The financing terms include varied interest rates, along with the security may be a lot more substantial in comparison to the loan amount. It’s essential to do appropriate research before looking for private loaning options. It’s also important to work alongside trustworthy loan providers, verify their references and measure the dangers and expenses associated with every single loaning determination.

To put it briefly:

Backing your perspective is critical to reaching your company desired goals. San Francisco private financing options give you a versatile and speedy method to obtain the money you need to expand your business. Even so, it’s essential to carry out thorough research just before agreeing to any exclusive financing solutions to be aware of the risks and benefits associated with the lending terminology. In so doing, you may successfully acquire financing to gas your business’s progress, getting your eyesight alive.